December 2020

‘Fiscal and monetary stimulus is powering a surprisingly strong rebound in economic activity, and particularly trade, led by Asia and the US. The first flush will be wearing off by the end of 1Q21

‘Fiscal and monetary stimulus is powering a surprisingly strong rebound in economic activity, and particularly trade, led by Asia and the US. The first flush will be wearing off by the end of 1Q21.’

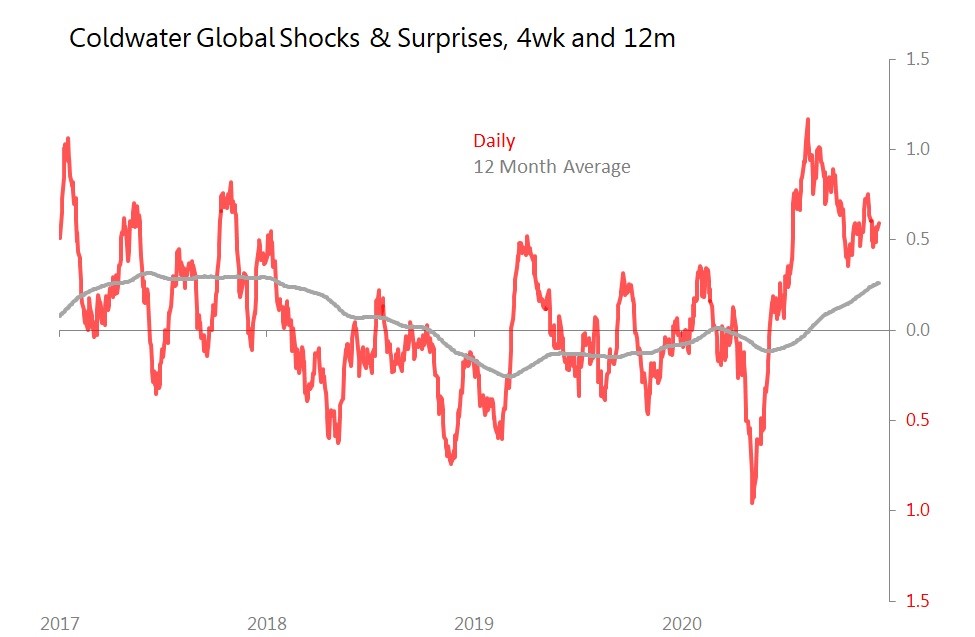

The pandemic and the massive monetary and fiscal policy responses it provoked, make 2020 a year unlike any other in recent economic history. Longstanding plans and strategies, longstanding expectation sets have all been destroyed, rebuilt and destroyed again. As we get to the end of 2020, we can see that the rebound in the second half of the year was as surprising as the first half onslaught of disease was shocking. The Coldwater Global Shocks & Surprises Index, which forms part of the universe of signals the Coldwater Fast Model responds to, ends the year in solidly positive territory.

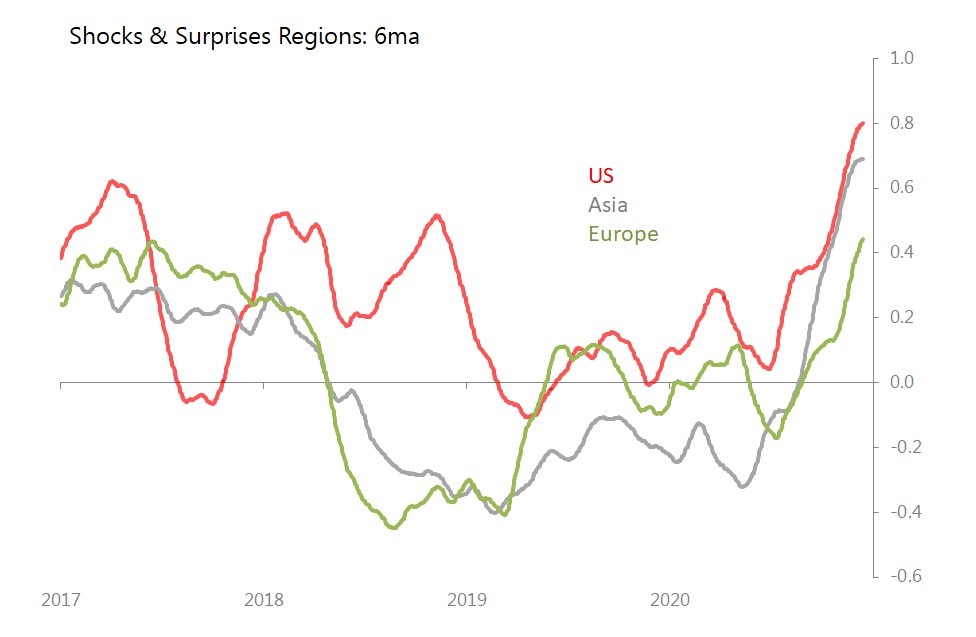

By December, the economic rebound from covid’s first wave is clear everywhere, but the impact from the second wave has yet to really show up in the data. Asia has started reporting November data, and it is encouraging; US November data by contrast shows nothing worse than a moderation back towards ‘normal’ patterns. Europe’s data emerges only slowly, so it’s November results are almost exclusively confidence surveys, which record the hopes stirred by the announcement of coronavirus vaccines.

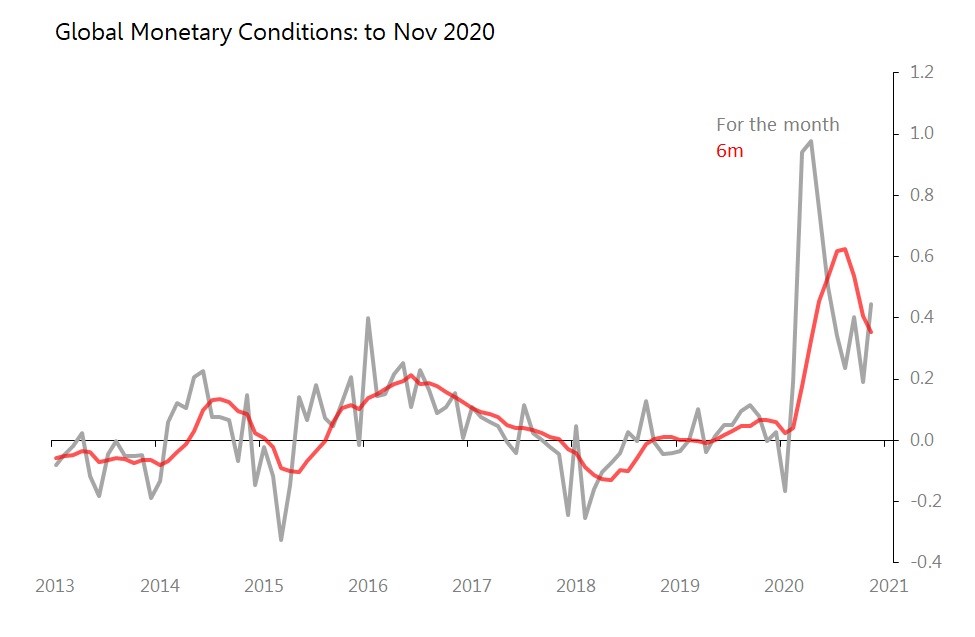

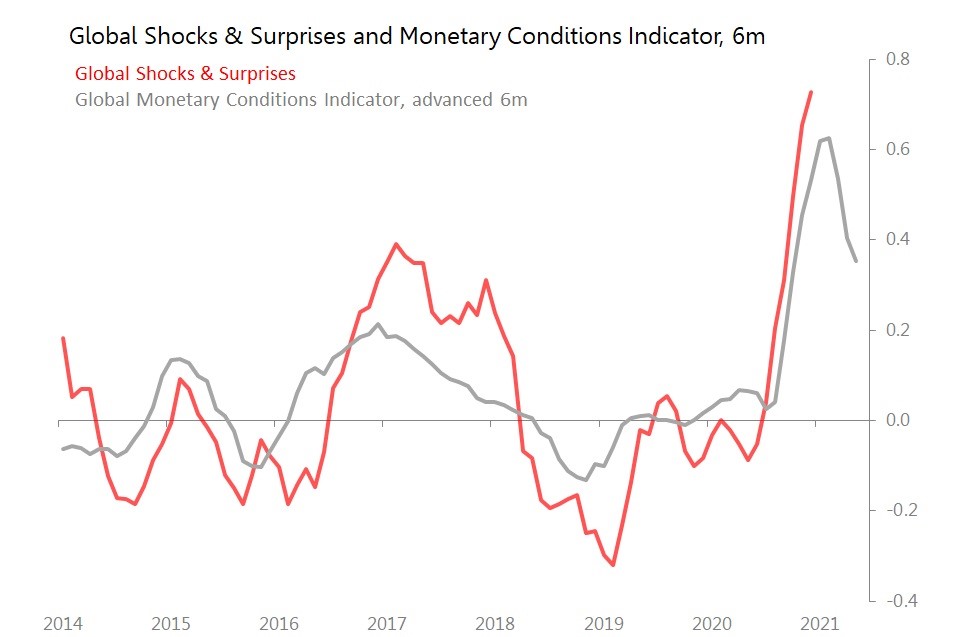

The peak of this rebound in economic data is almost certainly still a few months distant, since global monetary conditions remain highly accommodating, even as the emergency measures of Spring 2020 recede into the distance. During November, the main new positive contributors to global monetary conditions were the US and to a lesser extent China, whilst conditions in Japan and the Eurozone were broadly neutral. However, by the end of 1Q21 the impact of the massive stimulus packages of 2020 will be wearing off, and we can expect to see some weakening, with Europe and Japan more exposed than the US and China.

For now, however, the underlying pattern seems clear: 2020 ends with Asia in fully-fledged recovery, with bounces in the data even greater than the rebounds seen in the US and Europe. The surprising strength of Asian data reverses not just the shocks associated with covid, but a generally disappointing run of data which extends back to early 2018, as the 6m chart below shows.

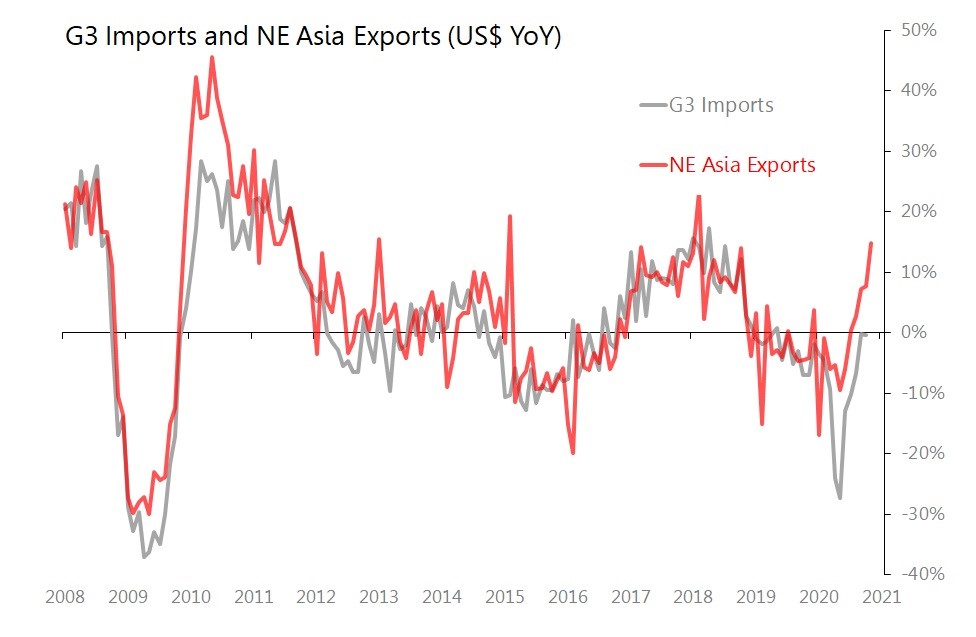

The most obvious sign of this Northeast Asia’s export numbers. We now have enough data for November’s trade to be able to estimate that NE Asia’s exports jumped 14.9% yoy, with a monthly deflection from 5yr seasonalized trends of 0.7SDs. This is the largest yoy gain since (holiday-affected) February 2018. The 0.6SDs deflection above 5yr seasonalized trends seen over the last six months is the most positive rise vs underlying momentum since 2005! It is also running dramatically ahead of the recovery in G3 import demand, which usually sets the parameters for NE Asia’s export performance.

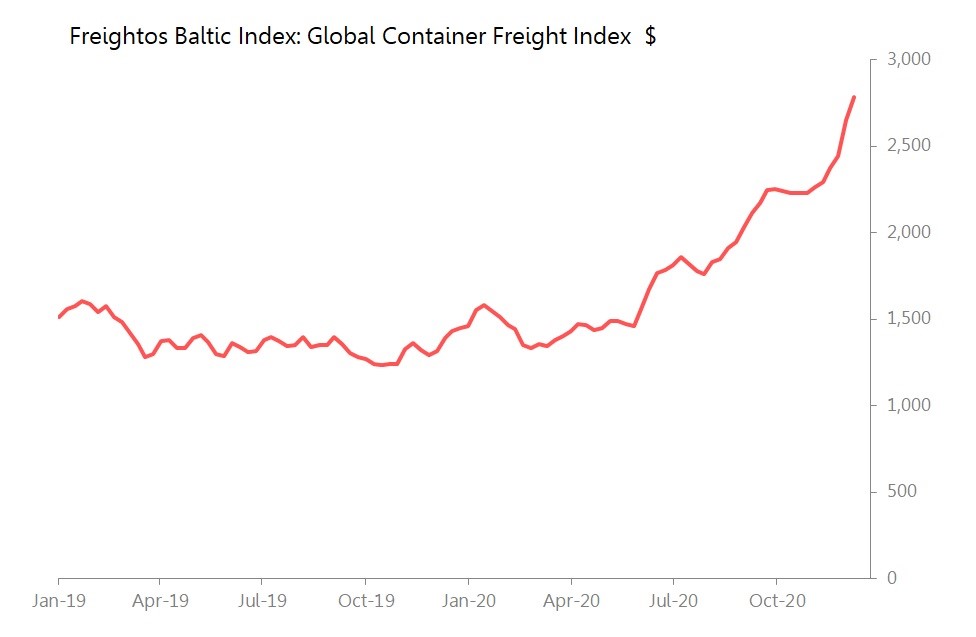

In response, container freight rates are surging: in the week to 11th Dec, the Freighto Baltic Index put container rates at US$2,782, almost exactly double the rate a year ago. This rise tells us the fractures in supply-chains and the need to rebuild inventory are beginning to put pressure on trade prices. This has not yet fed through to inflation measures anywhere. The assumption that inflation will remain dead will be tested In 2021.